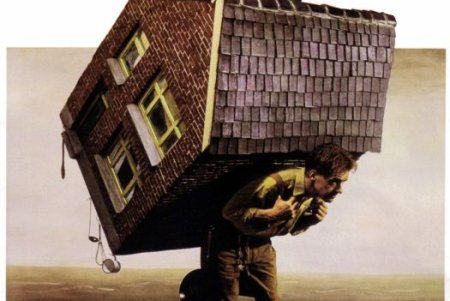

Mortgages and their payments become a headache as we advance in age. The situation has improved a little with the top American home loan providers and both the state and the federal governments signing a settlement. This was followed by the President announcing more such plans to help the consumers with their loan payments.

A new plan has been unveiled that has completed eliminated the fees associated with the refinancing of any federal mortgage. This discount, according to the President, would save an average family around $1,000 each year. About 2 and 3 million Americans, who received their refinancing through the Federal Housing Association (FHA), would be benefitted by this change.

The government is unable to regulate the real estate market by itself. But it should not be expected from the consumers that they will be waiting for the market to hit rock bottom so that they can get some relief. Instead they should consider the existing options and make a difference in the situation.

This change has come as a response to the fee hike by the FHA over the past few years so as to cover up the losses incurred due to the defaulted loans. This change will reportedly make the lending process easier for the lenders as well as the borrowers. Those who are planning to refinance now will have to pay 0.1% of the loan as an upfront mortgage premium and an annual fee of 0.55%. But their ongoing fee has been reduced if they make a down payment of 3.5% when they purchase their house.

This is being seen as the latest step taken by the new government in order to lighten the burden of the distressed homeowners who are struggling to pay their monthly installments on the home mortgage. However, many of the steps taken earlier for the same purpose has irked the beneficiaries whom the plans targeted as the qualifying criteria were too high to be achieved. Many across the country could not qualify for them for this reason. In many instances the value of the homes for which the borrowers were paying the mortgage had dropped below the actual price faced enormous trouble qualifying for the benefit. As a result of all these difficulties these steps failed to help a majority of the people whom the plan was designed to benefit. However, the new Mortgage payment Relief plan is being rumored as a better step.

Recruiting right talent for your company isn't easy. It requires lot of time and efforts to invite applications for a new job opening and eventually selecting the best candidate for the job. By using some online recruitment system, you can possibly save plenty of time and money, that goes in complete recruitment process and make HR efforts far more efficient.

Recruiting right talent for your company isn't easy. It requires lot of time and efforts to invite applications for a new job opening and eventually selecting the best candidate for the job. By using some online recruitment system, you can possibly save plenty of time and money, that goes in complete recruitment process and make HR efforts far more efficient.

Wow, that seems to be a great way to get relief from our mortgages. Thanks for sharing this information Vijay Raj.

PrIyAnGsHu recently posted..Freelance Content Writing- Everything You Should Know